FOMC Minutes Recap: September 16-17 Meeting Released October 8, 2025

Executive Summary

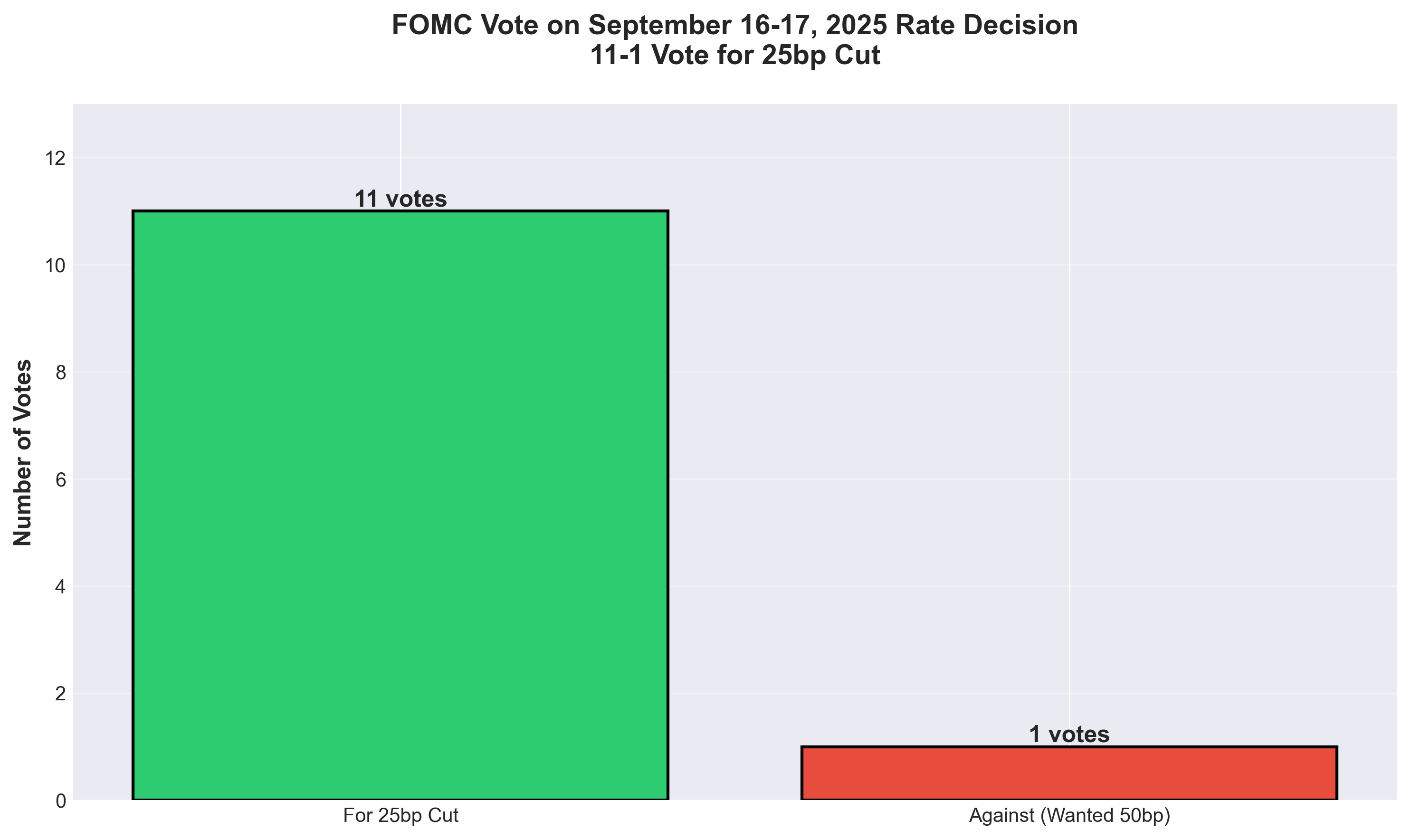

The Federal Reserve released the minutes from its September 16-17, 2025 FOMC meeting on October 8, revealing a central bank navigating competing pressures between a softening labor market and persistent inflation concerns. The Committee voted 11-1 to cut rates by 25 basis points to a range of 4.00%-4.25%, marking the first rate reduction of 2025.

Key Takeaways:

- Near-unanimous support for easing policy, with division centered on the pace of future cuts

- A slim 10-9 majority expects two more quarter-point cuts by year-end

- Policymakers emphasized rising downside risks to employment alongside persistent upside inflation risks

- Governor Stephen Miran dissented, preferring a 50bp cut instead of 25bp

- Markets rallied on the release, with the S&P 500 and Nasdaq hitting record closes

The Decision: First Rate Cut of 2025

The FOMC voted 11-1 to lower the federal funds rate by 25 basis points to a target range of 4.00% to 4.25%, effective September 18, 2025. This marked the Committee's first rate reduction since beginning its aggressive tightening campaign in 2022.

FOMC Vote Breakdown - 11-1 Decision for 25bp Cut

The Vote Breakdown:

The decision received overwhelming support, with only one dissenting vote. Governor Stephen Miran, who had been sworn in just hours before the meeting began, voted against the decision—not because he opposed easing, but because he preferred a larger 50 basis point cut. Miran argued that "further softening in the labor market over the first half of the year and underlying inflation that in his view was meaningfully closer to 2 percent than was apparent in the data" warranted more aggressive action.

This dissent is notable as it came from the dovish side of the spectrum, highlighting that disagreement within the Committee centered not on whether to cut, but on how quickly to ease policy.

What the Minutes Revealed

A Divided Committee on the Path Forward

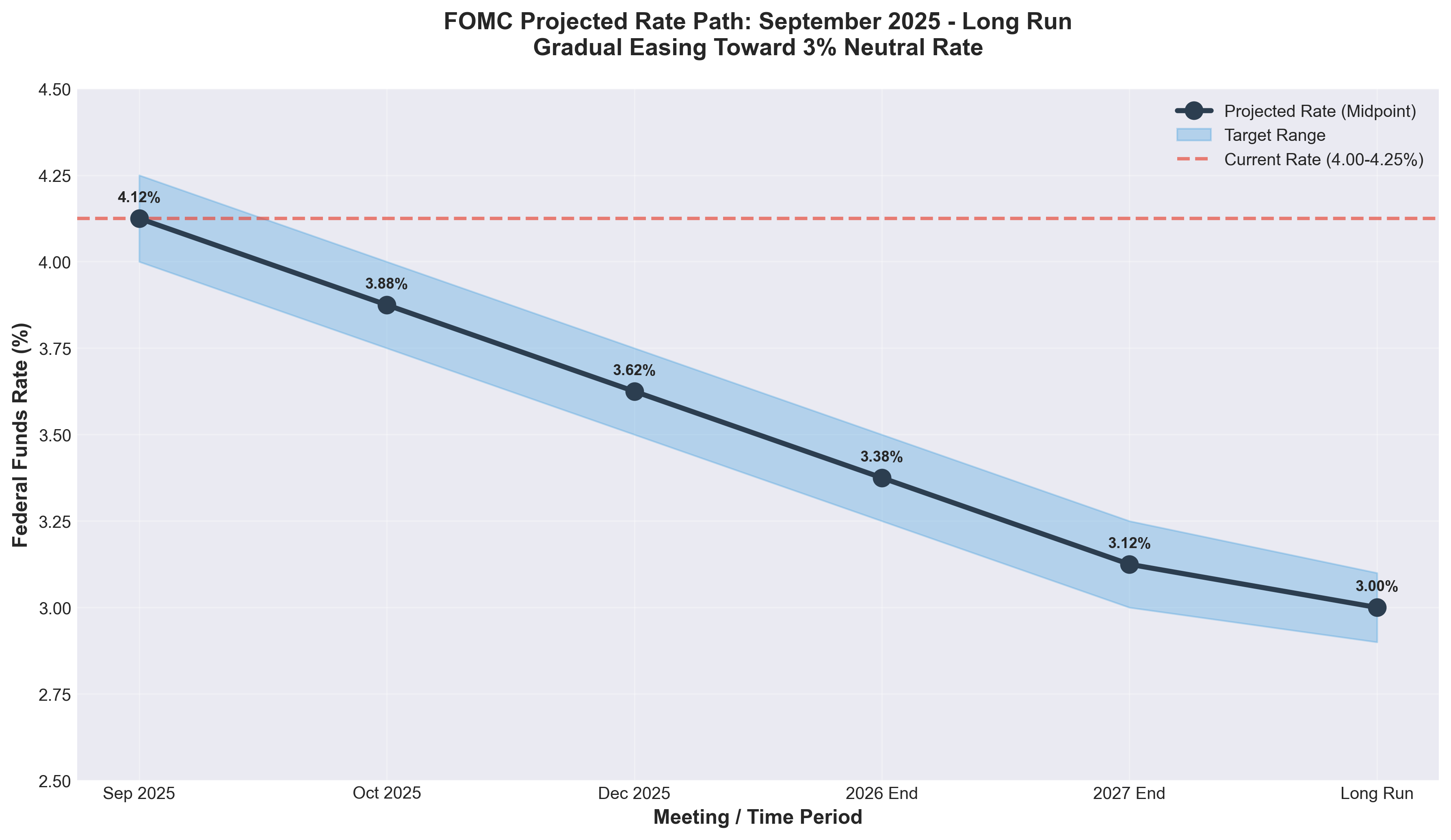

While the September decision itself was nearly unanimous, the minutes exposed significant division regarding future policy moves. The "dot plot" projections showed a razor-thin 10-9 split, with the slim majority favoring two additional quarter-point cuts by year-end.

FOMC Rate Path Projections Through Year-End 2025

The minutes stated that "most judged that it likely would be appropriate to ease policy further over the remainder of this year," but added critical nuance: "Some participants noted that, by several measures, financial conditions suggested that monetary policy may not be particularly restrictive, which they judged as warranting a cautious approach in the consideration of future policy changes."

Labor Market Concerns Take Center Stage

A central theme throughout the minutes was the Committee's growing concern about labor market softening. Policymakers noted that:

- Job gains had slowed notably over recent months

- The unemployment rate had edged up to 4.3% in August

- The Bureau of Labor Statistics' preliminary benchmark revision indicated payrolls were more than 900,000 lower than previously reported

The minutes revealed that "participants generally noted that their judgments about this meeting's appropriate policy action reflected a shift in the balance of risks," with downside risks to employment having increased substantially. Several participants cited concentrated job gains in only a few sectors and rising unemployment rates among historically cyclical-sensitive groups as warning signs.

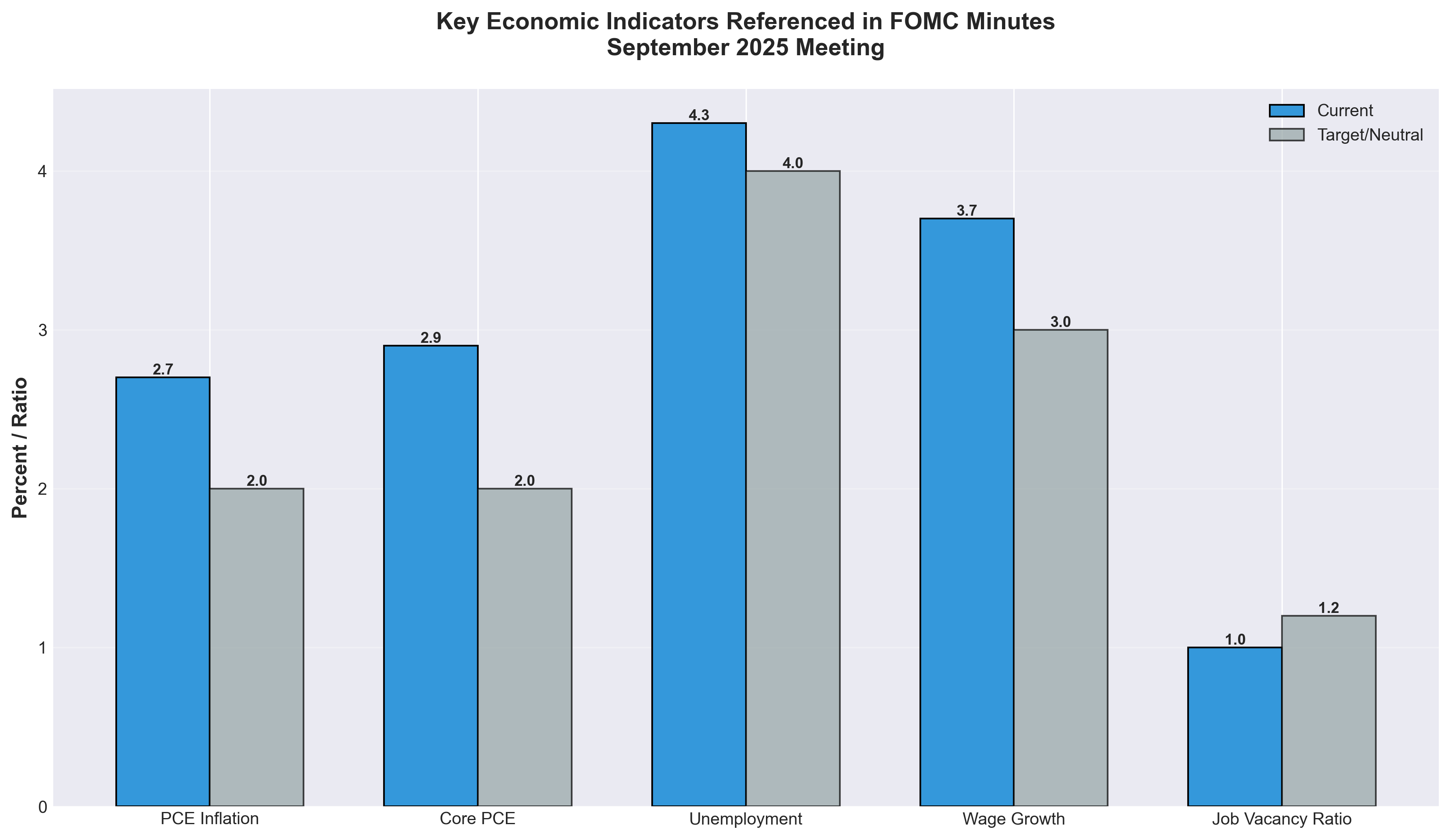

Persistent Inflation Worries

Despite acknowledging progress, a majority of participants emphasized upside risks to their inflation outlooks. The minutes stated: "A majority of participants emphasized upside risks to their outlooks for inflation, pointing to inflation readings moving further from 2 percent, continued uncertainty about the effects of tariffs, the possibility that elevated inflation proves to be more persistent than currently expected."

Key Economic Indicators Tracking Inflation and Employment

Key inflation concerns included:

- Consumer price inflation remained at 2.7% year-over-year in August (PCE basis)

- Core inflation stood at 2.9%, at the upper end of the year's range

- Uncertainty about tariff impacts on prices persisting into 2026

- Risks that longer-term inflation expectations could become unanchored if inflation doesn't return to target promptly

Financial Conditions and Market Dynamics

The minutes revealed an interesting observation: despite the restrictive policy stance, financial conditions remained relatively accommodative. Equity prices stood near record highs, credit spreads were at historically tight levels, and corporate bond issuance remained robust.

This dynamic created a tension within the Committee, with some members questioning whether policy was truly restrictive enough to warrant aggressive easing. The minutes noted that "equity prices continued to rise over the intermeeting period and stood very close to record highs despite the recent weaker-than-expected employment reports."

Economic Assessment

GDP and Growth Outlook

The staff's economic projection was revised upward compared to the July forecast, "primarily reflecting stronger-than-expected data for both consumer spending and business investment as well as financial conditions that were projected to be a little more supportive of output growth."

However, growth had moderated in the first half of 2025 relative to 2024, with real GDP rising in Q2 after declining in Q1. The Committee expected growth to pick up in 2026 as the effects of tariff increases and slower immigration diminish.

Labor Market Dynamics

The Committee's assessment of labor market conditions evolved significantly. Beyond the headline unemployment rate, policymakers examined multiple indicators:

- The ratio of job vacancies to unemployed workers stood at 1.0 in August

- Wage growth measures showed continued deceleration (3.5% for private sector compensation, 3.7% for average hourly earnings)

- Labor force participation had declined somewhat from earlier in the year

- The percentage of unemployed workers finding jobs and the quits rate among employed workers suggested a cooling but not collapsing labor market

Inflation Trajectory

Policymakers generally expected that "given appropriate monetary policy, inflation would be somewhat elevated in the near term and would gradually return to 2 percent thereafter." The staff projection anticipated inflation reaching the 2% target in 2027 and remaining there in 2028.

However, significant uncertainty remained about:

- The ultimate impact of 2025 tariff increases on price levels

- Whether productivity gains would continue to offset cost pressures

- The potential for second-round effects if inflation proves more persistent

Forward Guidance and Market Implications

Policy Path: Cautiously Dovish

The minutes revealed a Committee intent on maintaining flexibility while leaning toward further easing. The key phrase: "most judged that it likely would be appropriate to ease policy further over the remainder of this year" -signals the baseline expectation of additional cuts, but stops short of pre-committing to a specific path.

Importantly, the minutes emphasized that "monetary policy was not on a preset course and would be informed by a wide range of incoming data, the evolving outlook, and the balance of risks."

The Government Shutdown Complication

A critical challenge emerged after the September meeting: the federal government shutdown that began October 1 has delayed key economic data releases. The Labor Department has suspended publication of employment reports, and other crucial indicators remain unavailable.

This data blackout means that at the October 28-29 FOMC meeting, policymakers will be "flying blind" on key metrics for inflation, unemployment, and consumer spending. The minutes acknowledged this uncertainty indirectly, noting elevated policy uncertainty regarding "trade, immigration, fiscal spending, and regulation."

Balance Sheet Runoff Continues

The Committee unanimously agreed to continue reducing the Federal Reserve's securities holdings. However, the minutes revealed growing attention to reserve levels. Several participants noted that "with reserves declining and expected to decline further, it was important to continue to monitor money market conditions closely and evaluate how close reserves were to their ample level."

The Standing Repo Facility (SRF) saw $1.5 billion in usage on September 15, suggesting some emerging strains in money markets, though policymakers assessed that reserves remained abundant overall.

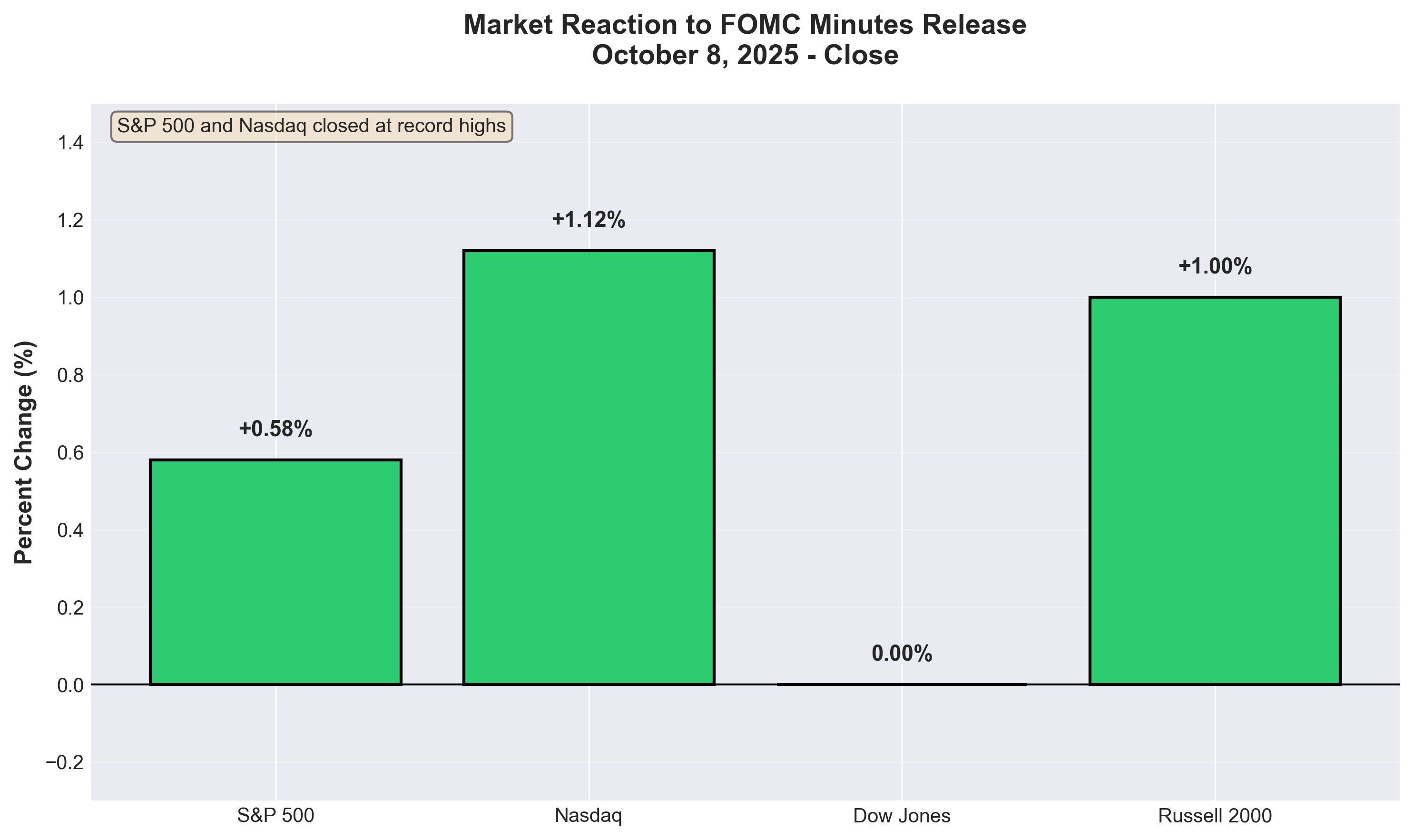

Market Reaction: Record Highs on Dovish Tilt

Markets responded positively to the October 8 minutes release, interpreting the content as confirming expectations for additional rate cuts while not signaling any hawkish surprises.

Market Performance Following FOMC Minutes Release - October 8, 2025

Market Performance on October 8, 2025:

S&P 500

+0.58% to 6,753.72 (record close)

Nasdaq Composite

+1.12% to 23,043.38 (record close)

Dow Jones Industrial Average

Flat at 0.00%

Russell 2000

+1.00%

The rally was led by technology and semiconductor stocks, with Advanced Micro Devices surging 11% on separate OpenAI partnership news. The combination of dovish Fed signals and strong tech sector momentum drove risk appetite.

Rate Expectations:

Following the minutes release, fed funds futures pricing showed:

- 96% probability of a 25bp cut at the October 28-29 meeting

- Market consensus for 2-3 total cuts by year-end

- Terminal rate expectations around 3% in the longer run

Treasury yields initially dipped following the release, with the 2-year yield showing particular sensitivity to the dovish employment language, before stabilizing as traders digested the inflation concerns.

The Bottom Line

The September FOMC minutes paint a picture of a Federal Reserve committed to easing policy in response to labor market softening, but proceeding cautiously amid persistent inflation concerns and extraordinarily tight financial conditions. The key tension between preventing unnecessary labor market deterioration and avoiding premature easing that could reignite inflation, which will define policy decisions through year-end.

Three Critical Factors for October:

1. The Data Void:

The government shutdown has eliminated visibility into September employment and inflation data, forcing the Fed to rely on August readings and alternative indicators. This unprecedented lack of information could push policymakers toward their baseline expectation of one more 25bp cut rather than surprising markets.

2. The 10-9 Split:

The razor-thin majority favoring two more cuts suggests the Fed could easily shift to a more cautious stance if incoming data (when available) shows inflation resilience or financial conditions loosening further.

3. Financial Conditions Paradox:

With equities at records, credit spreads at historic tights, and the VIX subdued, the Committee faces questions about whether policy is truly restrictive, potentially arguing for fewer cuts than markets expect.

What to Watch:

- Resolution of the government shutdown and subsequent data releases

- Any Fed speaker commentary between now and the October 28-29 meeting

- Corporate earnings reports as a real-time indicator of economic health

- Money market stress indicators as the balance sheet runoff continues

The Committee has signaled its intentions clearly: more cuts are likely, but the pace and magnitude remain data-dependent and subject to the evolving balance of risks. For investors, the message is clear expect gradual easing, not aggressive stimulus.

Sources

[1] Federal Reserve Board - FOMC Minutes, September 16-17, 2025

https://www.federalreserve.gov/monetarypolicy/fomcminutes20250917.htm[2] CNBC - Fed minutes September 2025: Divided FOMC saw another two rate cuts by the end of 2025

https://www.cnbc.com/2025/10/08/fed-minutes-september-2025.html[3] EBC Financial Group - Will the Fed Minutes on Oct 8, 2025, Signal a Rate Cut?

https://www.ebc.com/forex/will-the-fed-minutes-on-oct-8-2025-signal-a-rate-cut[4] TheStreet - Stock Market Today: Chipmaker Rally, FOMC Minutes Lift S&P 500 and Nasdaq

https://www.thestreet.com/markets/stock-market-today-october-8-2025[5] Yahoo Finance - A divided Fed sees more rate cuts ahead this year: FOMC minutes

https://finance.yahoo.com/news/a-divided-fed-sees-more-rate-cuts-ahead-this-year-fomc-minutes-190100540.html⚠️ Disclaimer

This analysis is for educational and informational purposes only and should not be considered investment advice. The Federal Reserve's policy decisions involve complex economic considerations and carry inherent uncertainty.