S&P 500 Weekly Performance: Sept 29 - Oct 3, 2025

SPY ETF Analysis

Source: MT Blue Analysis Team

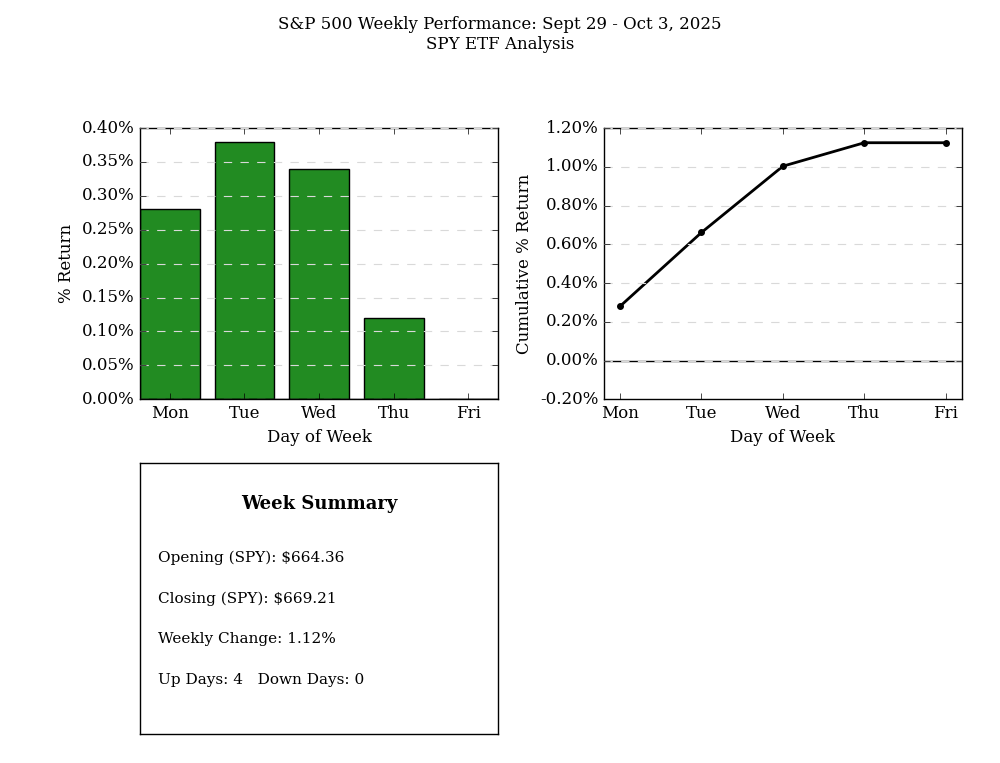

The Week in Numbers

Previous Close

$663.68

Week Close (SPY)

$669.21

Weekly Change

+$5.53 (+0.83%)

Trading Range

$661.61 - $672.67

SPY closed the week at $669.21, up $5.53 or 0.83% from the previous week's close of $663.68. The market showed strong momentum with 4 positive days and 1 flat day, demonstrating consistent buying interest throughout the week.

The week saw a trading range from a low of $661.61 to a high of $672.67, representing an $11.06 range as markets navigated key macro events.

What Moved Markets This Week

The Macro Picture

This week's market action unfolded against an interesting backdrop. Markets demonstrated relative stability despite several crosscurrents including the government shutdown that began on October 1st and ongoing debates around fiscal policy.

Federal Reserve Outlook

Chicago Fed President Goolsbee made headlines this week, noting he's "a little wary" about cutting interest rates too quickly. The Fed continues to balance inflation concerns with employment data, and policymakers are taking a measured approach to rate decisions.

Market Drivers

Several themes emerged throughout this week:

- Volatility remained relatively subdued, which can support systematic flows and buyback activity

- Technology and mega-cap names continued to play an outsized role in index performance

- Healthcare names showed some strength during the week

- Markets opened Monday essentially flat, pausing after recent gains

- Tuesday through Thursday saw consistent buying interest with three consecutive up days

- Mid-week strength was notable, with steady gains building momentum

Looking Ahead

Markets are navigating a complex environment with several factors in play. The upcoming economic calendar and Fed commentary will be key inputs for direction. Investors are watching how policy uncertainty, inflation trends, and labor market data evolve.

Key considerations include the government shutdown's impact on economic data releases, the Fed's path forward on rates, and how mega-cap concentration affects overall market dynamics.

The Bottom Line

This week showed markets can digest political noise and maintain an upward bias when volatility stays contained. That said, concentration in a handful of names means index performance doesn't tell the whole story about market breadth and underlying strength.

*This recap synthesizes publicly available market data and news for educational purposes. Markets involve risk and past performance doesn't predict future results*

Sources

[1]: SPY prices

https://www.investing.com/etfs/spdr-s-p-500-historical-data[2]: Government shutdowns

⚠️ Disclaimer

This analysis is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or an offer to buy or sell any securities. Past performance does not guarantee future results. Always conduct your own research and consult with a qualified financial advisor before making investment decisions.